41 when self checking math worksheets pdf

Surface Area of a Rectangular Prism Worksheets - Softschools.com Surface Area of a Rectangular Prism Worksheets, Geometry Worksheets for 4th grade, 5th grade and middle school FREE Printable Winter Skip Counting Puzzles Math Activity These super cute, free printable Winter Skip Counting Puzzles are a fun way to practice counting by 1s, counting by 2s, counting by 5s and counting by 10s. This winter math activity is lots of fun for January with preschool, pre k, kindergarten, first graders, and 2nd grade students. Simply print the winter printables pdf file and have fun with this skip counting activity that is self checking!

Self Checking Math Worksheets & Teaching Resources | TpT PDF (13.03 MB) This pack was created to provide teachers with simple centers that students can check themselves for immediate feedback. Included in this pack are 9 fall themed puzzles covering a variety of math skills. These are perfect as simple, self-checking centers. The following concepts are included: • w.

When self checking math worksheets pdf

PDF Math Fact Fluency Worksheets - SkillsTutor Log In Math Fact Fluency Worksheets Author: SkillsTutor Created Date: 10/20/2008 4:56:43 PM ... First Grade Math Worksheets - Free PDF Printables with No Login Math worksheets for first graders that your students will want to complete. Emphasis on improving number learning with patterns, addition, subtraction, and math fact fluency. First Grade Math Worksheets - Free PDF Printables with No Login First Grade Addition Worksheets First Grade Subtraction Worksheets First Grade Word Problems. Free 6th Grade Math Worksheets Free Math Worksheets for Grade 6. This is a comprehensive collection of free printable math worksheets for sixth grade, organized by topics such as multiplication, division, exponents, place value, algebraic thinking, decimals, measurement units, ratio, percent, prime factorization, GCF, LCM, fractions, integers, and geometry.

When self checking math worksheets pdf. Writing Worksheets Printable worksheets for writing paragraphs, letters, addresses, and more. Also includes self and peer editing checklists. Customary Measurement Conversion Weight Activity Self Checking Math Center The individual triangles form a self checking larger hexagon shape once all the problems are solved. The puzzle comes pre-mixed up so that students could cut them out themselves and not know the answers. These games are always a big hit when I pull them out for my students. Includes. 30 problem self checking puzzle; Conversion worksheet Integers Worksheets | Online Free PDFs - Cuemath Download Integers Worksheet PDFs. Integers worksheets should be practiced regularly and can be downloaded for free in PDF format. Integers Worksheet - 1. Download PDF. Integers Worksheet - 2. Download PDF. Integers Worksheet - 3. Download PDF. Integers Worksheet - 4. Math Self Assessment Checklist Teaching Resources | TpT Common Core Self Assessment Check List {3rd Grade Math} by Katie Jones 34 $2.00 PDF It is important for students to be able to self assess their learning. This product comes with a 5 page check list for students to keep track of their learning during math. The standards are worded in "I can" statements on the checklist.

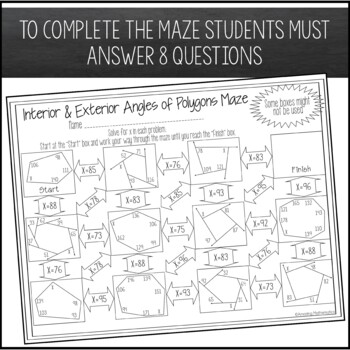

FREE Multiplication Hopscotch Printable Math Game 3rd Grade Worksheets. Looking for mre fun, free 3rd grade worksheets, games, and activities to make learning fun?Check out these resources: Wonderful books for 3rd graders; Free Grade 3 Math Worksheets pdf; Printable Maps - free printable maps to label as you like; What is the Earth Made of science experiments and lesson for kids; Astronomy for Kids - unit with lots of clever lessons ... PDF Everyday Math Skills Workbooks series - Home Math invisible. But math is present in our world all the time - in the workplace, in our homes, and in our personal lives. You are using math every time you pay a bill, book a flight, look at the temperature for the day or buy paint for your house. Home Math is one workbook of the Everyday Math Skills series. The other workbooks are: FREE Maze Challenge Telling Time Games Printable Telling Time games. Kids will love these telling time games printable because they are more fun than just a typical clock worksheets, these time worksheets are actually a FUN math activity for kindergartners, grade 1, and grade 2 students to practice using a clock. Plus, this clock activity is self-checking: they'll know they missed something if they don't make it to the finish! Addition 5 Minute Drill H 10 Math Worksheets With - Pinterest Grade 1, 1st grade, Year 1 (Printable Worksheets) Includes over 120 worksheets, Including the following: 1. Book Addition for GRADE 1 2. Fill in the Blanks 3. Add and Subtract mixed 4. Mental Math 5. Skip Count This is a BUNDLE Package. If you would like to purchase some of these worksheets separately you can find them in… C Clphllips Math methods

Worksheets | Teachers Pay Teachers This bundle includes a huge set of clipart, packed with bright images, as well as a PDF for easy printing to create bulletin boards, banners, and more!If you have found yourself creating materials for distance learning or are navigating through homeschooling your own kids, these bright colorful graphics can help create a happy learning space! Addition 5 Minute Drill H 10 Math Worksheets With | Etsy | Math ... Mar 21, 2020 - Addition 5 minute drill (10 Math Worksheets with answers) WORKBOOK includes: 10 WORKSHEETS with answers (20 pages) This workbook is ideal to give the student that extra practice to gain confidence and proficiency in math topics. ... Includes pdf FILE: 10 WORKSHEETS Printable Size: US Letter (8.5\" x 11\") -Print or you can Fill ... Math Worksheets for Students - 9+ PDF | Examples You may also see self-assessment worksheet examples in pdf. 8. Mathematics is essential in a world of constant change Advanced technology are changing the way people work and live. Mathematics can be very useful in understanding how and why things work the way they work. 9. Math will be more represented in the future FREE Printable Multiplication Valentines Day Math Activity The super cute heart Valentines Multiplication game is a fun, self-checking Valentines Math for 3rd grade, 4th grade, 5th grade, and 6th grade students to work on math fluency for February 14th. Simply print pdf file and you are ready to play and learn with this valentine's day math activities.

Publication 560 (2021), Retirement Plans for Small Business 1 Net earnings from self-employment must take the contribution into account. See Deduction Limit for Self-Employed Individuals in chapters 2 and 4. 2 Compensation is generally limited to $290,000 in 2021. 3 Under a SIMPLE 401(k) plan, compensation is generally limited to $290,000 in 2021.

0 Response to "41 when self checking math worksheets pdf"

Post a Comment